What does a median salary indicate. During the 4 weeks off i would generally be on 2 or 3 weeks vacation before either going back to Malaysia or Australia.

Income Tax Formula Excel University

Personal Tax 2021 Calculation.

. You might need to send money abroad to make a foreign property purchase or you could be a business working with contractors around the globe. After that tax rates begin at 12 and go up. I have a yearly rented property here i have company letter cancelling my WP.

Resident stays in Malaysia for more than 182 days in a calendar year. Annual income RM36000. Working in Dubai has the lure of a lavish lifestyle the most scintillating shopping experiences skyscrapers and of course a much better salary package.

Tax rebate for Spouse husband or wife Rebate amount. For the most part foreigners working in Malaysia are divided into two categories. It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss.

1 Taxes are withheld from my Salary and in this case I will need to lodge a tax return to the ATO. According to Salary Explorer the 2022 median salary in Japan is 545000 JPY 4730 USD per month. Ali work under real estate company with RM3000 monthly salary.

To calculate your individual lump-sum tax you will need to disclose all your assets to Swiss authorities. In other words even if you earned a higher annual income it wouldnt make you any much happier. This tax rebate is why most Malaysia n fresh graduates or those in their first two years of work will not need to worry about income tax payments.

Finally it will state the amount the employee receives after these withholdings. By Angus Deaton the 2015 Nobel laureate in economics he found that the correlation between emotional wellbeing and annual income tops out at US75000. Insurance is a means of protection from financial loss.

However if you are a resident of the UK there are. The value represents the mid-point that divides the Japanese working population in half. The starting salary of the SSC CGL Income Tax Inspector and Income Tax Officer is somewhere around 44900 INR along with a grade pay that ranges somewhere between 4000-5500 INR.

Life insurance policies not only provide life coverage to an individual but are also an excellent way to save on taxes. Chargeable income less than RM35000 can get a RM 400 tax rebate so Ali does not need to pay any tax amount to LHDN. Under the Section 80 GG the self-employed or the salaried person can claim a HRA tax exemption or the rent paid by him or her in excess of 10 of hisher income or salary respectively.

They will use this information to determine your annual rent. Who should pay Income Tax. If youre looking to make a successful career in Dubai heres what you can expect on the pay.

In fact pay in Dubai is income tax-free and often considered better even than the UK now. If you are a non-resident of the UK you will not have to pay tax for foreign income. In life insurance policy one need pay premiums every year which in return is paid back in large lump-sum amount in case of demise of the insured person.

My company paid my salary and i have the obligation to pay all income tax myself. Currently you can pay a lump-sum tax in the following countries and pay zero tax on all foreign source income. According to a well-known study in the US.

The upper ceiling is 25 which means that rent paid in between 10 and 25 of the salaryincome is only available for deduction HRA exemption. You will be granted a rebate of RM400. Let us discuss how insurance helps one save income tax.

My WP and non-b visa finish in early 2019. A payslip also known as a salary slip or pay stub is a document given to an employee by their employer. As a general rule anyone earning a salary in Malaysia is required to pay income tax unless they fall into one of the exceptions.

Money transfer is taxed depends largely on your residency. My questions is if to pay the tax obligation before i leave do they give me proof i have paid my taxes as immigration might want to see it or. So 50 of Japanese people earn above the median income while the other half earn less.

Payslips detail the amount of pay given before tax as well as the tax insurance and other company schemes including pensions that have been deducted. You dont have to pay taxes in Malaysia if you have been employed in the country for less than 60 days or for income that is earned from outside Malaysia. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file.

If your chargeable income does not exceed RM 35000 after the tax reliefs and deductions. Chargeable income RM20000. Total tax amount RM150.

This limit exceeds Rs300000 for senior citizens and Rs500000 for super senior citizens. It is mandatory to file ITR for individuals If the gross total income is over Rs250000 in a financial year. So how much money do you actually need to be happy.

Malaysia adopts a territorial approach to income tax. As per the grade you are selected for there can be a mild variation in the salary. An entity which provides insurance is known as an insurer an insurance company an insurance carrier or an underwriterA person or entity who buys insurance is known as a policyholder while a person or entity.

Total tax reliefs RM16000. And become a resident again would I be liable to pay tax on my UAE income for the pro-rata.

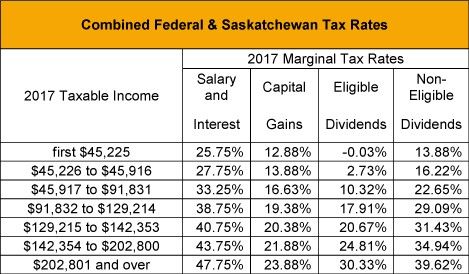

Saskatchewan 2017 Budget Sales Taxes Vat Gst Canada

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

How To Calculate Foreigner S Income Tax In China China Admissions

Cukai Pendapatan How To File Income Tax In Malaysia

Individual Income Tax In Malaysia For Expatriates

How Much Does A Small Business Pay In Taxes

Poland Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

Finland Taxing Wages 2021 Oecd Ilibrary

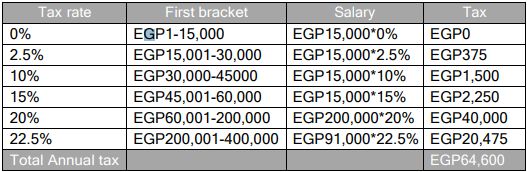

Latest Amendments In Income Tax Law In Egypt Law No 26 2020 Income Tax Egypt

How To Calculate Income Tax In Excel

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

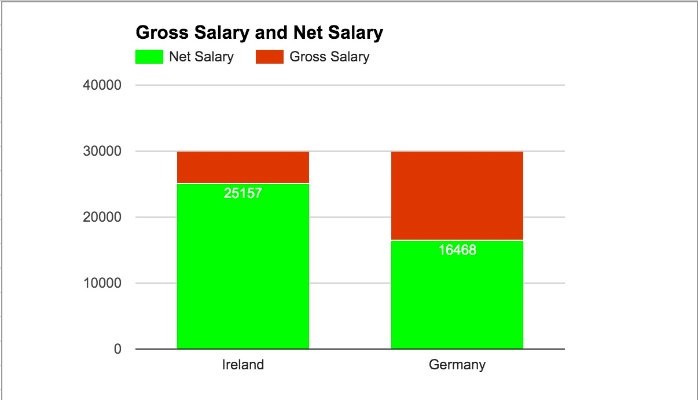

Income Tax Germany Versus Ireland

States Continue To Take Steps Toward Income Tax Elimination

How To Calculate Monthly Pcb Income Tax In Malaysia Mkyong Com

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel